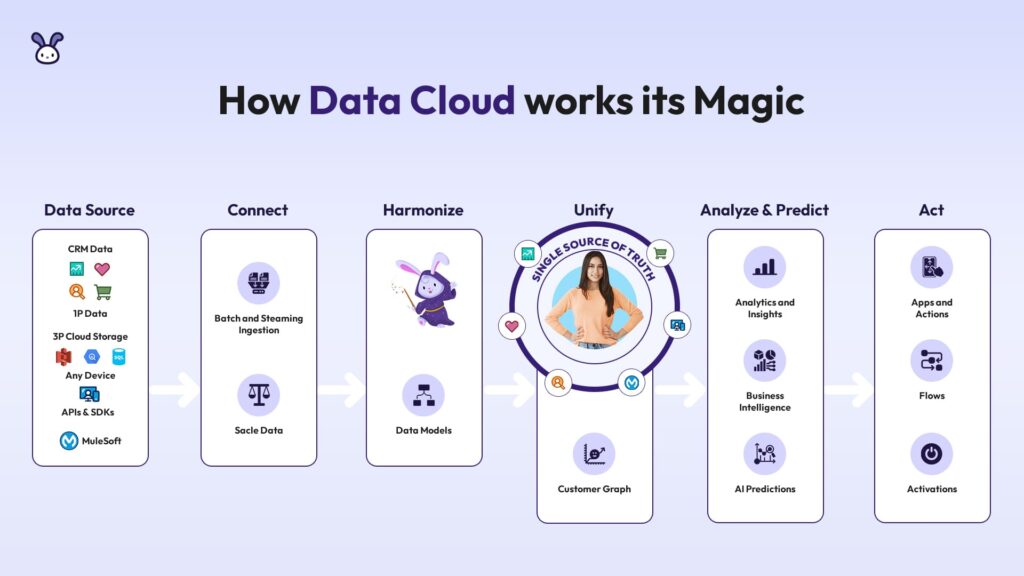

How Data Cloud helps financial institutions is becoming increasingly evident in today’s digital landscape. Financial institutions are one of the best places where Data Cloud can be used, offering a wide range of capabilities to unify and activate data across multiple channels of interaction, behavioral, and transactional data.

Financial institutions data might be from different systems like marketing cloud, existing loans, originations of loan details, customer transactions, website traffic…etc. We can create a unified profile in the Data cloud and harmonise the transactions data and events data that can bring accurate segments of the profiles.

We can use a calculated insight to define and calculate multidimensional metrics on your entire digital state in Data Cloud. You can create metrics at the profile, segment, and population levels.

Use Segments to identify major life events, such as graduation, first job, marriage, childbirth, divorce, retirement, or inheritance, to grow deposits and generate revenue.

Use Streaming Insights to detect possible fraudulent transactions and launch a real-time journey to notify customers to review any suspicious behavior.

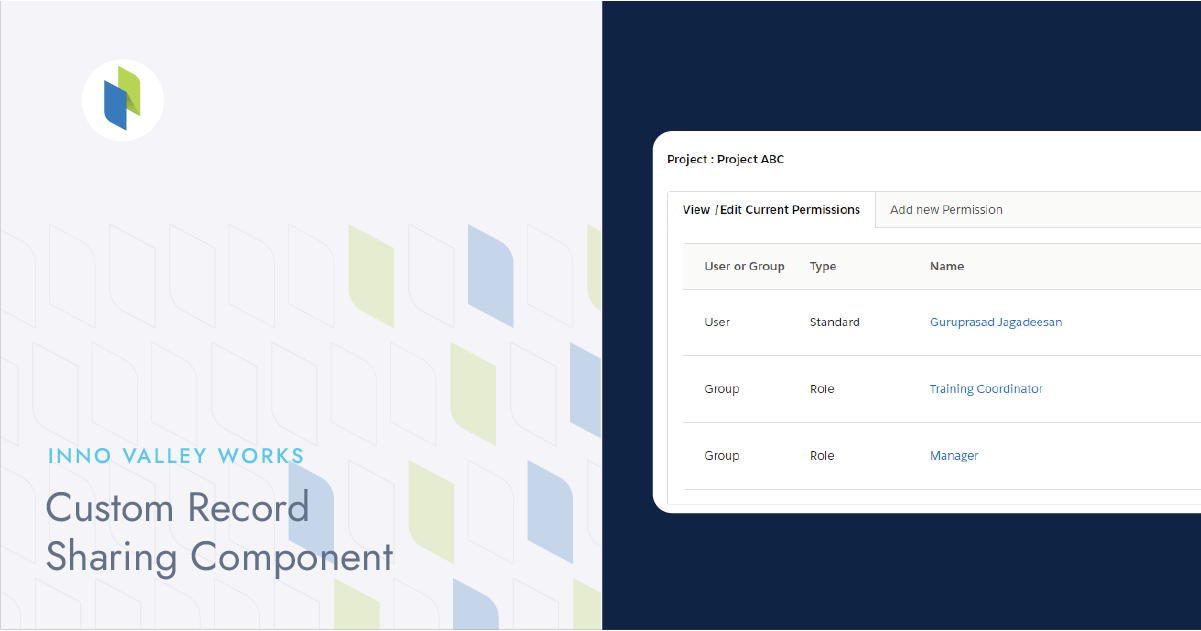

View client transaction data in pre-configured FlexCards that contain clickable actions that change according to the context in which they appear and based on the information that they contain. To display data on the FlexCards, Salesforce and Data Cloud must be on the same org. It is also possible to work together with omnistudi to display the calculated insights data. They let users view client transaction data in pre-configured FlexCards.

We will have a single source of truth, that helps the business to analyse and predict the data and customer behaviour. So the business can take necessary actions towards the customer behaviours.

.

.